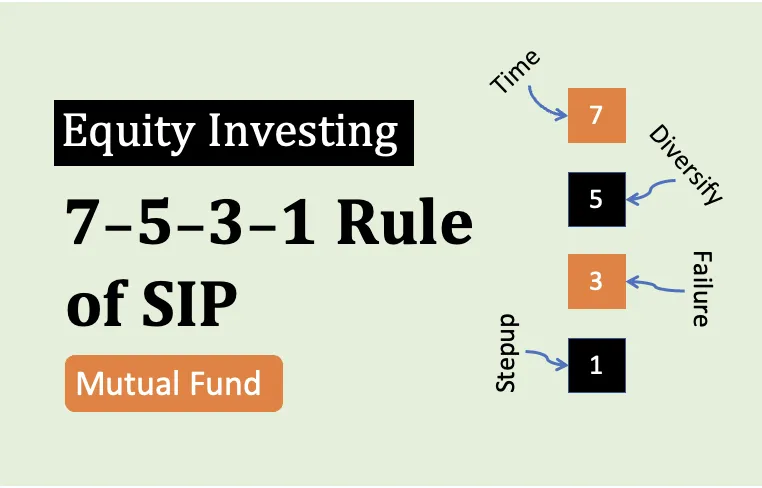

When it comes to investing, especially through SIPs (Systematic Investment Plans), many people struggle to understand how much return they can realistically expect over time. That’s where the 7-5-3-1 rule comes in—a simple yet powerful guideline that can help you build long-term wealth while keeping your expectations grounded.

📌 What is the 7-5-3-1 Rule?

| Number | Meaning | Explanation |

|---|---|---|

| 7 | 7% return from debt investments | This includes debt mutual funds or fixed deposits. These are considered safer than equities and typically offer around 7% annual return over the long term. |

| 5 | 5% return from savings accounts or safe instruments | Instruments like savings accounts or recurring deposits may give only 4–5%, which often fails to beat inflation. |

| 3 | 3% average inflation | This is the long-term average inflation rate in India, which eats into the value of your money over time. |

| 1 | 1% real return from ultra-safe investments | Once inflation is factored in, your actual gain from safe instruments may only be 1%, or sometimes even negative. |

🧠 Why This Rule Matters

Set realistic return expectations

Understand the impact of inflation

Encourage investors to choose the right asset mix

Emphasize the importance of long-term equity investing

💰 Example: Wealth Creation Through SIP

| Investment Period | Assumed Return | Wealth Gained |

|---|---|---|

| 10 years | 12% p.a. | ₹23.2 lakhs |

| 20 years | 12% p.a. | ₹99.9 lakhs |

| 30 years | 12% p.a. | ₹3.5 crores |

With time and patience, SIPs can help you create crores in wealth from relatively small monthly contributions.

🎯 Key Takeaways

The 7-5-3-1 rule helps simplify the understanding of different return levels and the effect of inflation.

For true wealth creation, you need to beat inflation by investing in growth-oriented assets like equity mutual funds.

Starting early and staying consistent with SIPs can help you achieve your financial goals with ease.

Final Thoughts

Use the 7-5-3-1 rule as a compass, not a calculator. It’s a reminder that safe doesn’t always mean smart when it comes to long-term investing. To beat inflation and build wealth, SIP into equity mutual funds, be consistent, and give your money the time it needs to grow.